What are Small and Large Stocks?

Cousin Vinny's apple cider production business has seen an explosive increase in profit. He has worked his way from his first experimental blend, to employing 20 former NBA centers as an elite group of apple pickers. Ladders aren't necessary for his outlandishly tall employees, so he believes that he can save on costs by not having a group disability insurance plan (I can’t make any recommendations in this blog, but this is probably a bad idea). On top of all of the cost savings, he believes that he has some of the best cider that the world has ever tasted. Vinny's Exotic Ciders (VEC) has become a public company, and you're trying to decide if it is a good fit for your portfolio.

On the other hand, you've realized that there is a Globo Gym (GG) on every corner in your city. This well-run establishment has a stranglehold on the global gym market. From Krasnoyarsk to Boston and everywhere in-between, GG is pressuring people into living a healthy lifestyle. You may not agree with their training methods, but you can't argue with the fact that they are a money making machine.

Assuming that these two companies never run into any ethical issues, how do you consider the risks associated with each investment? Does VEC have more room for growth as a smaller company, or will they be eaten alive by other competitors? Has GG squeezed every ounce of sweat that they can out of their business? Let's take a deeper dive into how to think about small and large company investments.

What is a small stock?

The size of a company is determined by looking at a metric called market capitalization (market cap), which is the aggregate price of all of the company's stock. Small cap companies are usually within the range of $300 million to $5 billion of market cap, although this definition changes depending on who you ask. I know, that seems massive, but it really isn't when some of the largest companies are worth over a trillion dollars in market cap now.

Here are a few small cap stocks that you may recognize:

GrubHub (GRUB)

Papa John's (PZZA)

Shake Shack (SHAK)

1-800-Flowers.com (FLWS)

Casper Sleep (CSPR)

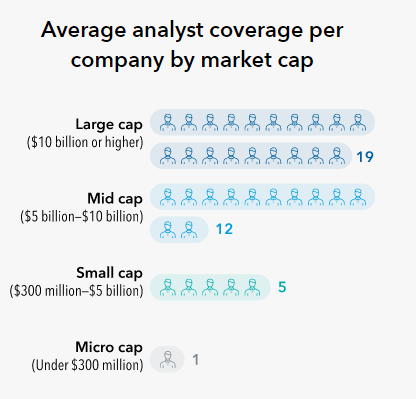

Sure, these aren't necessarily the most exciting company names out there. They don't get the same attention that the big guys get from Wall Street either. Analysts are tasked to give a rating to each company, and a forecast of where the stock price will be in the future. Everybody out there has a job to do, and these people surely know much more about each specific company than I ever will. But historically speaking, stock price forecasts are about as accurate as a weatherman predicting if it will rain next week.1 If someone could tell you with any certainty where a stock is headed, they wouldn’t need to work another day in their lives.

If you couldn't tell from the intro, there is typically a higher risk associated with investing in smaller stocks. But like everything in the investment world, there is a risk-return tradeoff. You should in theory require a higher rate of return for taking on that risk.2

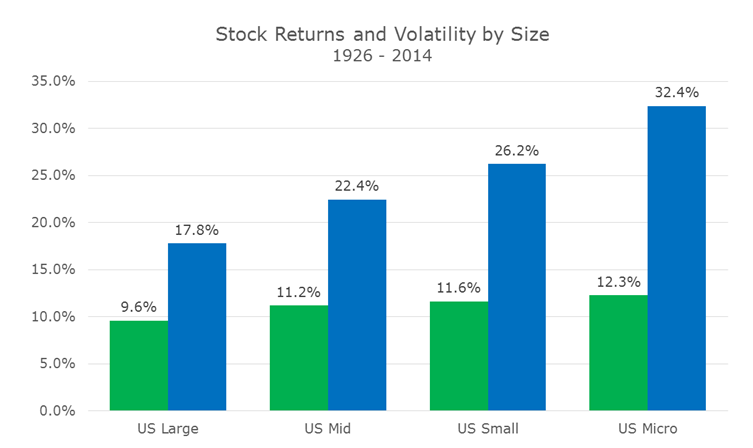

The chart below shows how US-based small cap companies have performed versus large cap companies, going back as far as possible (green is return, blue is volatility, data is annualized).

The important thing to keep in mind about this data is that it is measured using an average of many stocks over a long time horizon. There are plenty of companies in both categories that have done very well, and plenty that have gone out of business.

This chart isn't perfect because it doesn't include the last 6+ years of data, but it paints a picture of the risk associated with different investment categories. Most investors allocate more of their stock portfolio towards the large companies because the ratio of risk to return is better, but smaller companies shouldn't be ignored. A 2% difference compounded over time can make a serious impact on the outcome of your portfolio. If you can understand that there will be gyrations in the stock price that you won't be happy with for extended periods of time, small caps can be rewarding in the long-run.3

Some sources will tell you that companies are categorized as small cap just because they aren't mature companies yet. This is an oversimplification because market cap is a product of the stock price and the number of shares that have been issued. It doesn't matter how old the company is, it can become a large cap stock at any point in time by increasing enough in price. There is also a possibility that these companies could become completely worthless.

How do I invest in small caps?

You could try to find some small cap stocks that you are interested in and buy into them through whichever brokerage service you use (Fidelity, Schwab, Robinhood, or others).

Another approach is to use an ETF or a mutual fund to pick the stocks for you based on their method of selection. This can be a way to create a more diversified and systematic method of gaining exposure to small companies. Most brokerage services also have a list of ETFs and mutual funds that you can review to see which is right for you (here is one for Schwab and one for Fidelity that you can access once you open an account).

Morningstar will help you to figure out how much of each portfolio is categorized in each size bucket. Here is an example for a common small cap ETF.4

My next post will focus on the difference between ETFs and mutual funds. As always, please comment about any questions you have here, or anything else you would like me to write about!

https://scijinks.gov/forecast-reliability/ data shows that 10-day forecasts are roughly 50% accurate.

This does not always hold to be true for all risks in the financial markets.

Past performance doesn’t guarantee future results.

This is not a recommendation for this specific ETF, just an example.